OUR HEADLINE SPONSOR IS HUAWEI

[ycd_countdown id=2947]

[ycd_countdown id=2947]

Popular Journal

GHANA FINTECH AWARDS

Who will attend?

GHANA FINTECH AWARDS

Who will attend?

PROJECTS

Launched Projects

Women in Fintech

Top Fintech Voices

Debate

SPONSORS

2024 Sponsors

GHANA FINTECH AWARDS

What is the Award About?

Ghana FinTech Awards is an annual event aimed at identifying Financial Technology (FinTech) Companies and Banking Institution's stalwarts and celebrating their successes through the year. Individuals and companies are recognized and acknowledged for their efforts and achievements as they strive to build competitive and sustainable companies in a fast paced and challenging environment.

In addition, the Awards event aims at promoting Ghana's FinTech competitive advantage and the journey to building a resilient Fintech space for economic growth and achieving financial inclusion, thereby enhancing on the convenience of financial transactions.

The Ghana Fintech Awards has demonstrated an increase in scope over the years by expanding its reach and recognizing more differentiated fintech companies with the aim of encompassing emerging technologies. This is entirely due to the ability of Fintechs to be embedded or plugged into every industry that has an online presence or e-commerce.

THEME

Building Trust in Ghana’s Digital Economy: The Essential Role of Cybersecurity and Data Privacy

GHANA FINTECH AWARDS

What is the Award About?

Ghana FinTech Awards 2023 is an annual event aimed at identifying Financial Technology (FinTech) Companies and Banking Institution's stalwarts and celebrating their successes through the year. Individuals and companies are recognized and acknowledged for their efforts and achievements as they strive to build competitive and sustainable companies in a fast paced and challenging environment.

In addition, the Awards event aims at promoting Ghana's FinTech competitive advantage and the journey to building a resilient Fintech space for economic growth and achieving financial inclusion, thereby enhancing on the convenience of financial transactions.

The Ghana Fintech Awards has demonstrated an increase in scope over the years by expanding its reach and recognizing more differentiated fintech companies with the aim of encompassing emerging technologies. This is entirely due to the ability of Fintechs to be embedded or plugged into every industry that has an online presence or e-commerce.

THEME

Building Trust in Ghana’s Digital Economy: The Essential Role of Cybersecurity and Data Privacy

PURCHASE

Purchase tickets here

For seat reservation, kindly contact Cristina

+233(0) 598385685 | +233 (0) 241339037 | cristina@ghanafintechawards.org

For seat reservation, kindly contact Cristina

+233(0) 598385685 | +233 (0) 241339037 | cristina@ghanafintechawards.org

PURCHASE

Purchase tickets here

VVIP

₵4,800.00

(1 ticket)

₵32,000.00

Full VIP Table for Eight (8)

Category specific usher service

Soft drink, mineral water, fruit juices, wine - red and white and hard liquor.

Accessible food stand

Front rows seating

Dedicated internet access

Opportunity to sit among the Governor, Country Ambassadors, Chiefs, Sponsors, Managers, Association Presidents, and other Industry leaders

VIP

₵3,600.00

(1 ticket)

₵25,600.00

Full VIP Table for Eight (8)

Category specific usher service

Soft drink, mineral water, fruit juices, wines: red & white

Accessible food stand

3rd and 4th Row Seating

Free WIFI

Opportunity to sit among Managers, Organizers, Sponsors and other industry leaders

REGULAR

₵2,400.00

(1 ticket)

₵16,000.00

Full VIP Table for Eight (8)

Accessible food stand

Soft Drink, Mineral water and fruit juices.

Middle Seats

Free WIFI

Opportunity to sit among Award nominees and other attendees

POPULAR

₵1,600.00

(1 ticket)

Accessible food stand

Soft Drink, Mineral water and fruit juices.

Middle Seats

Free WIFI

Opportunity to sit among Award nominees and other attendees

For seat reservation, kindly contact Cristina

+233(0) 598385685 | +233 (0) 241339037 | cristina@ghanafintechawards.org

For seat reservation, kindly contact Cristina

+233(0) 598385685 | +233 (0) 241339037 | cristina@ghanafintechawards.org

PURCHASE

Purchase tickets here

POPULAR

₵1,600.00

(1 ticket)

Accessible food stand

Soft Drink, Mineral water and fruit juices.

Middle Seats

Free WIFI

Opportunity to sit among Award nominees and other attendees

REGULAR

₵2,400.00

(1 ticket)

₵16,000.00

Full VIP Table for Eight (8)

Accessible food stand

Soft Drink, Mineral water and fruit juices.

Middle Seats

Free WIFI

Opportunity to sit among Award nominees and other attendees

VIP

₵3,600.00

(1 ticket)

₵25,600.00

Full VIP Table for Eight (8)

Category specific usher service

Soft drink, mineral water, fruit juices, wines: red & white

Accessible food stand

3rd and 4th Row Seating

Free WIFI

Opportunity to sit among Managers, Organizers, Sponsors and other industry leaders

VVIP

₵4,800.00

(1 ticket)

₵32,000.00

Full VIP Table for Eight (8)

Category specific usher service

Soft drink, mineral water, fruit juices, wine - red and white and hard liquor.

Accessible food stand

Front rows seating

Dedicated internet access

Opportunity to sit among the Governor, Country Ambassadors, Chiefs, Sponsors, Managers, Association Presidents, and other Industry leaders

For seat reservation, kindly contact Cristina

+233(0) 598385685 | +233 (0) 241339037 | cristina@ghanafintechawards.org

For seat reservation, kindly contact Cristina

+233(0) 598385685 | +233 (0) 241339037 | cristina@ghanafintechawards.org

PURCHASE

Purchase tickets here

POPULAR

₵1,600.00

(1 ticket)

Accessible food stand

Soft Drink, Mineral water and fruit juices.

Middle Seats

Free WIFI

Opportunity to sit among Award nominees and other attendees

REGULAR

₵2,400.00

(1 ticket)

₵16,000.00

Full VIP Table for Eight (8)

Accessible food stand

Soft Drink, Mineral water and fruit juices.

Middle Seats

Free WIFI

Opportunity to sit among Award nominees and other attendees

VIP

₵3,600.00

(1 ticket)

₵25,600.00

Full VIP Table for Eight (8)

Category specific usher service

Soft drink, mineral water, fruit juices, wines: red & white

Accessible food stand

3rd and 4th Row Seating

Free WIFI

Opportunity to sit among Managers, Organizers, Sponsors and other industry leaders

VVIP

₵4,800.00

(1 ticket)

₵32,000.00

Full VIP Table for Eight (8)

Category specific usher service

Soft drink, mineral water, fruit juices, wine - red and white and hard liquor.

Accessible food stand

Front rows seating

Dedicated internet access

Opportunity to sit among the Governor, Country Ambassadors, Chiefs, Sponsors, Managers, Association Presidents, and other Industry leaders

For seat reservation, kindly contact Cristina

+233(0) 598385685 | +233 (0) 241339037 | cristina@ghanafintechawards.org

Features

Quick Easy Flexible

This is a great site for everything around the home, and it also has a useful beauty section. You can see the best products in each category and they even have test results to back up the information they are giving you.

Time With the Bank of Ghana

AWARDS HIGHLIGHTS

2023 Awards Highlights

Lifetime Achievement Award

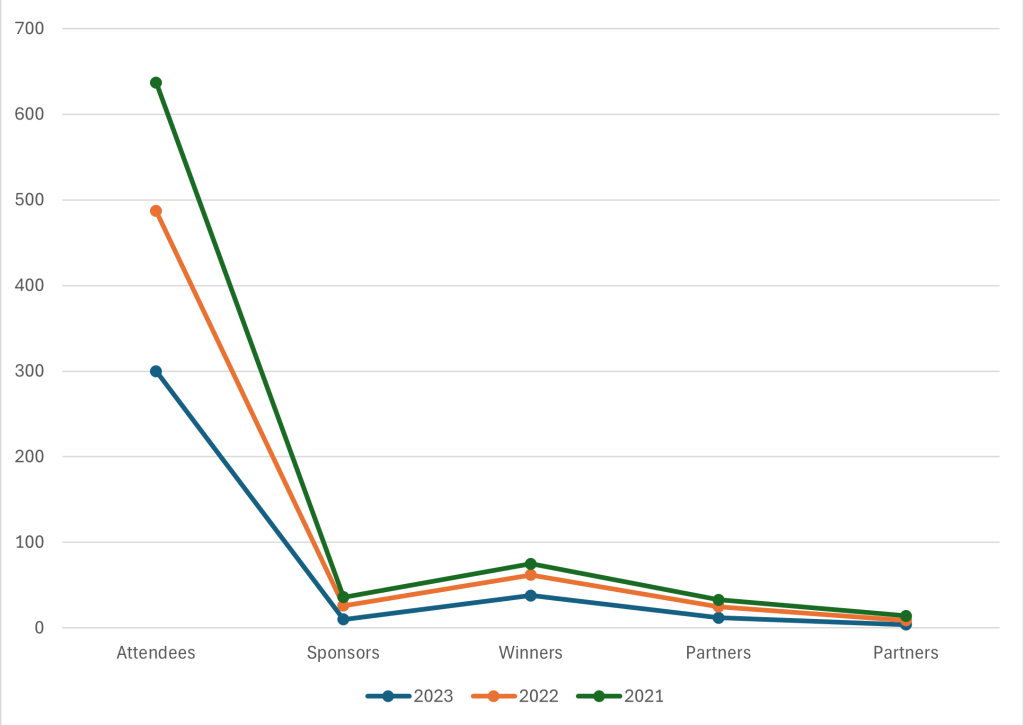

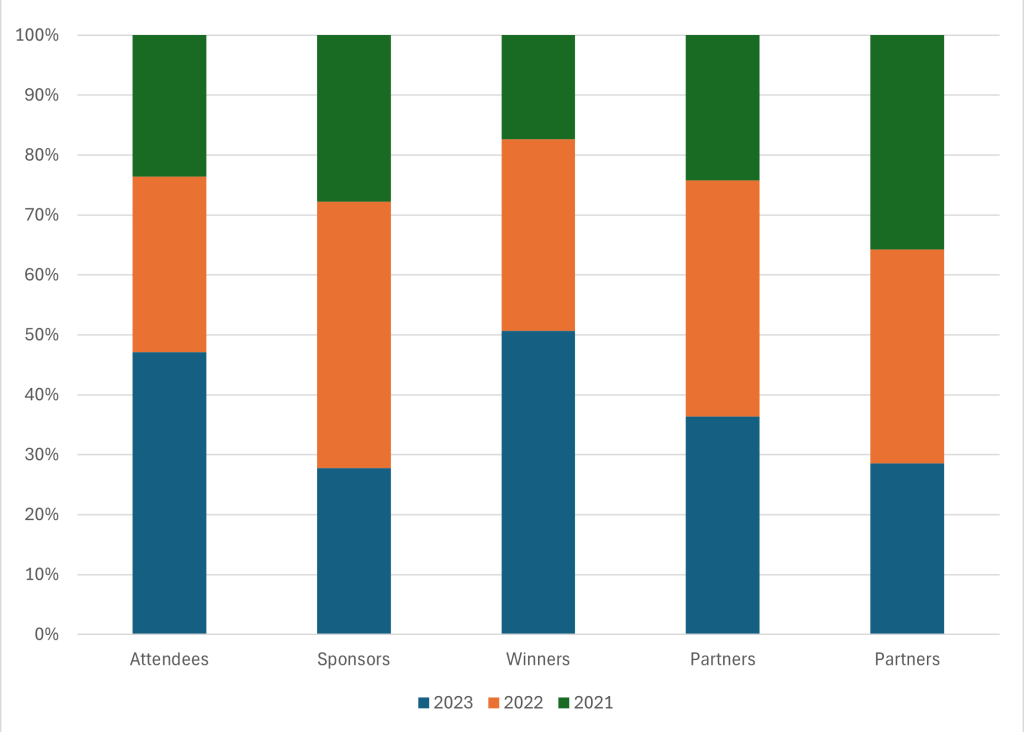

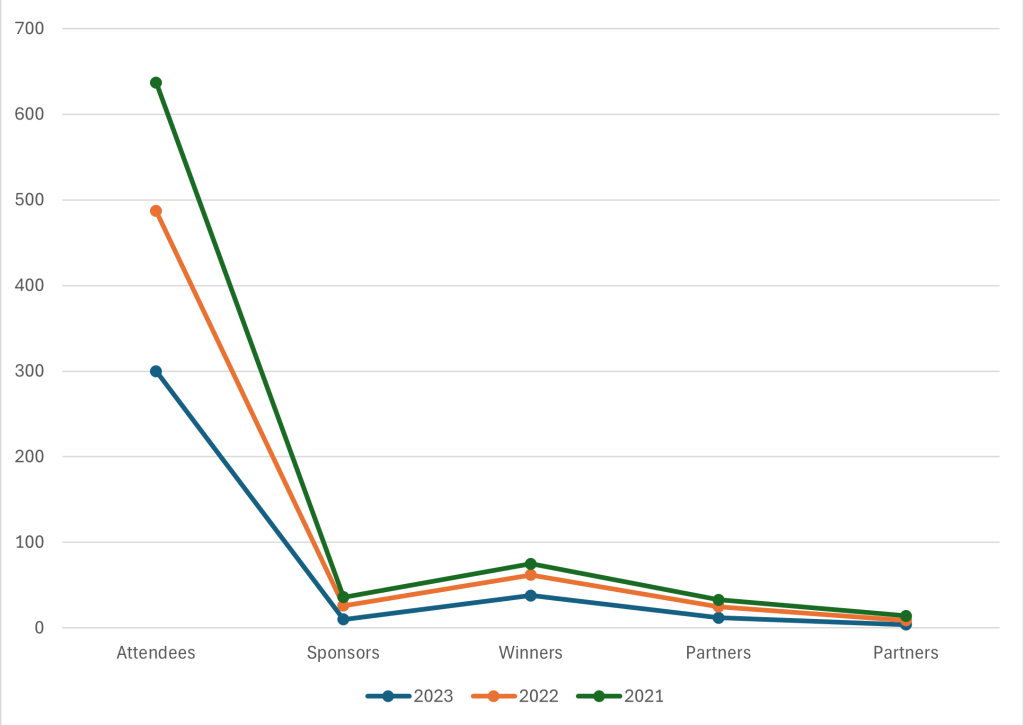

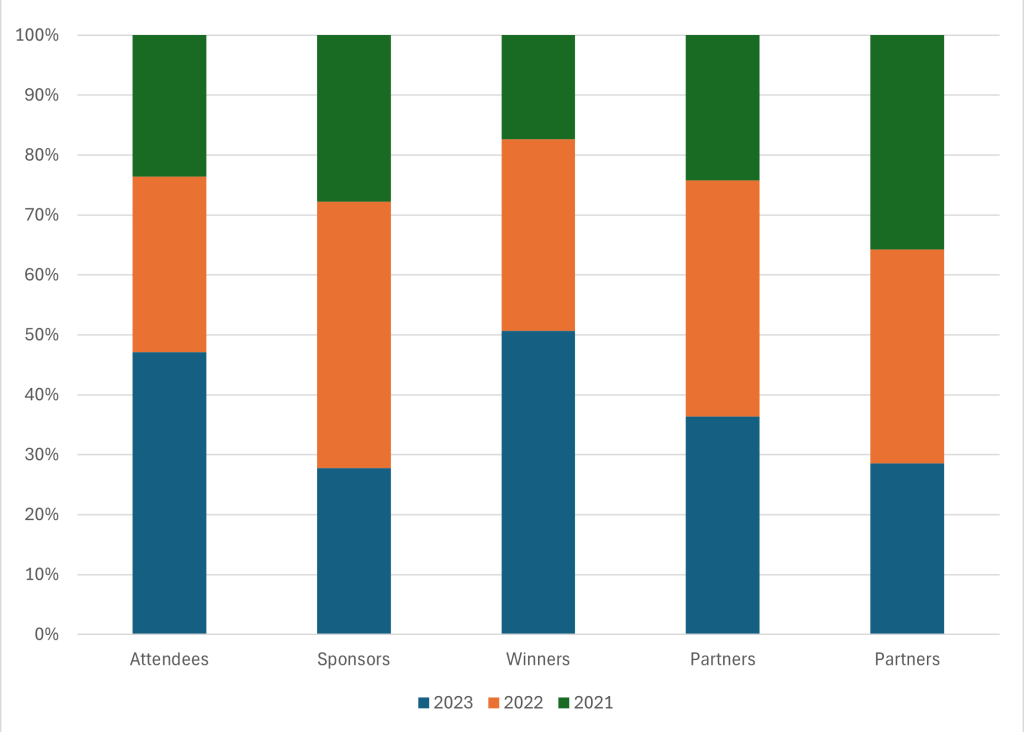

AWARD STATISTICS

2021-2023 Stats

AWARD STATISTICS

2021-2023 Stats

PARTNERS

Meet Our 2023 Partners

VIDEOS

Past Event Videos

PARTNERS

Meet Our 2024 Partners

SPONSORS

2023 Sponsors

2025 AWARDS

2025 Award Categories

2024 AWARDS

2025 Award Categories

2024 AWARDS

2024 Award Categories

- Fintech company of the year

- Fintech CTO/CIO of the year

- Fintech Start-up of the year

- Young Fintech leader of the year

- Leading Payments Technologies Service Provider

- Cybersecurity company of the year

- Long standing Fintech company of the Year(NEW)

- Mobile Micro-Insurance Innovator of the Year(NEW)

- Mobile Forex Innovator of the Year (NEW)

- Fintech Law Firm of the Year (NEW)

- Remittance Company of the Year(NEW)

- Fintech Personality of the Year (Male)

- Fintech Personality of the Year (Female)

- Banking Innovative Product of the Year (SME/Corporate)

- Fintech & Bank partnership of the year

- FIntech & Non-Bank partnership of the year

- Fintech Innovation of the year

- Fintech Platform of the Year

- Fintech for Financial Inclusion firm of the year

- Healthtech of the year

- Compliant Fintech Company of the Year

- Mobile Banking App of the Year

- Digital Bank of the Year

- ESG Bank of the Year

- Banking Innovative Product of the Year (Retail)

- Micro Finance - Fintech Partnership of the year(NEW)

- Crowd Funding company of the year NEW

- Venture Capital of the Year (NEW)

Please help by donating

HOW DID FINTECH COME BY IN GHANA

Brief Insight of FinTech in Ghana

The National Financial Inclusion and Development Strategy seeks to increase financial inclusion from 58% to 85% by 2023 to create economic opportunities and reduce poverty. Additionally, the Digital Financial Services Policy aims at building a resilient, inclusive and innovative digital ecosystem that contributes to social development, a robust economy and a thriving private sector.

Ghana has made time tested strides and achieved immense growth within the financial services sector, with the operations of financial technologies (fintech) industry into mainstream financial services delivery. This gives testament to the sound financial stability and secure environment achieved through the Government's digitisation agenda and the Bank of Ghana's regulatory framework, as spelt out in the Payment Systems and Services Act 2019.

Bloomberg reveals investments in African tech startups, especially as fintechs make up 60% of these companies, funding is expected to exceed US$5billion as recorded from last year. Various research findings have pointed to a continued rise in fintech investments in Africa despite the global economic downturn as it relates to the COVID-19 pandemic, the Russia-Ukraine war disrupting global supply chains.

While fintech in Africa is expected to grow at an annual rate of 10%, reaching about $230 billion in revenues by 2025, Ghana's fintech industry is expected to witness a 15% at a compound annual growth rate (CAGR) until 2025 as predicted by McKinsey and Company (August, 2022). This places Ghana's Fintech Ecosystem as the fastest growing industry in Africa.

JUDGES PANEL

Meet Our Judges

SPONSORS

Meet Our 2021 Supporters

GALLERY

Check Out Our Gallery

BLOG